Promoting Secured Transaction Reform in the Middle East and North Africa

May 11, 2017 | 4 Minute ReadIncreasing access to finance in the Middle East and North Africa region is spurring economic growth through implementation of modernized secured transactions regulation.

Modern secured transaction laws increase the availability of credit and reduce its cost, by ensuring that lenders can collect debt and enforce their rights in movable property collateral through a timely and inexpensive process.

From a global perspective, the Middle East and North Africa (MENA) region is significantly behind in pursuing and operationalizing reforms to increase access to and availability of secured credit. As seen in the table below with data from the latest World Bank Enterprise Survey, only 25.6 percent of firms in the MENA region have a bank loan or line of credit. Furthermore, collateral requirements average more than 200 percent. Additionally, 35 percent of businesses in the MENA region identify “lack of access to finance” as a constraint. The need for reforms to improve access to credit is glaring.

On March 13 to 14, the USAID Middle East Bureau partnered with the Asia and Middle East Economic Growth Best Practices project (AMEG), the U.S. Department of State, and USAID Bureau for Economic Growth, Education, and the Environment to hold the MENA Secured Transaction Reform Workshop in Nicosia, Cyprus. The workshop welcomed 40 participants including representatives from ministries of justice, finance, and central banks in Morocco, Jordan, Tunisia, Iraq, Egypt, and West Bank and Gaza, as well as the top international experts in secured transaction reform including the chairman of the United Nations Commission on International Trade Law (UNCITRAL) Secretariat and senior advisors from the National Law Center.

The purpose of the workshop was to build awareness about the benefits of secured transaction reforms to a country’s economy, what is entailed in a modernized secured transaction system, and how to both pursue and operationalize reforms to improve access to credit and economic growth throughout the MENA region. The goal for the workshop was to help attendees understand secured transaction reforms, feel proficient to make the case for reform in their home countries, and work to pursue reforms in the future.

USAID and U.S. Department of State representatives facilitated discussions on the current status of secured transaction reform in the region, the importance of secured transaction reforms in terms of future economic growth, key elements of a modernized secured transaction system and collateral registry, as well as other key reforms to support micro, small, and medium enterprises (MSME) growth in the MENA region. The workshop emphasized the importance of not just pursuing reform, but operationalizing reform and how to ensure buy-in from the necessary key players to implement the modernized regulation. MENA country representatives were able to network with top leaders in secured transaction reform and seek advice on how to launch the reform process, how to push reforms forward, and how to improve upon existing secured transactions systems that are limiting access to finance for MSMEs. Attendees left the workshop with a clear understanding of the impact that secured transactions reforms can have on economic growth and a new motivation to return back to their countries and pursue reforms.

USAID and U.S. Department of State representatives facilitated discussions on the current status of secured transaction reform in the region, the importance of secured transaction reforms in terms of future economic growth, key elements of a modernized secured transaction system and collateral registry, as well as other key reforms to support micro, small, and medium enterprises (MSME) growth in the MENA region. The workshop emphasized the importance of not just pursuing reform, but operationalizing reform and how to ensure buy-in from the necessary key players to implement the modernized regulation. MENA country representatives were able to network with top leaders in secured transaction reform and seek advice on how to launch the reform process, how to push reforms forward, and how to improve upon existing secured transactions systems that are limiting access to finance for MSMEs. Attendees left the workshop with a clear understanding of the impact that secured transactions reforms can have on economic growth and a new motivation to return back to their countries and pursue reforms.

Key takeaways

The workshop presented an abundance of useful and applicable information for participants including:

- Key challenges to implementing secured transaction reform for the MENA region as whole are largely due to:

- Implementing reforms in countries with strong civil law tradition has proven difficult, and MENA is no exception.

- Political instability and challenging security situations often delay and sometimes derail the reform process.

- Very little awareness and knowledge about movable asset-based lending and very few movable asset-based lending products currently being offered by financial institutions inhibit reform efforts.

- The UNCITRAL Model Law (2016) is a highly recommended model to reference when drafting secured transaction reforms. The UNCITRAL model will ensure consistency between laws and can then result in ease of cross-border transactions.

- Colombia and Mexico have both passed reforms and operationalized modernized secured transaction laws and systems including electronic registries for movables. Both countries can be seen as success stories for pursuing reforms. The 2014 adoption of Colombia’s modern secured transaction registry system led to more loans registered in the first six months than previously registered in total for the past 30 years, and since the launch of the registry, access to finance for women has increased by 39 percent.

- West Bank and Gaza is the most recent MENA country to have secured transaction reforms passed and is currently in the process of establishing a movables registry.

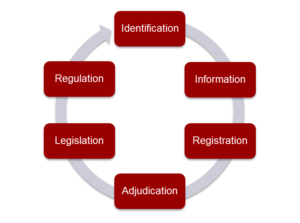

- Before pursuing reforms, countries need to become intimately familiar with their secured lending system. A best practice for the process is following the outlined steps on the right:

- Expedited enforcement mechanisms and alternative dispute resolution/online dispute resolution are critical aspects of a modernized secured lending system.

- Technologies such as cloud software and blockchain should be explored when creating new online collateral registries.

- There is an increasing demand to introduce sharia-compliant modifications into secured transaction regimes, models, and existing laws, specifically in the MENA region.

Next steps

Each country that attended the workshop obtained clear action items to start or continue pursuing. USAID and the State Department provided a summary of these action items to both the participants of the workshop and the USAID missions in each country so they are able to support their government agency to pursue reforms.

Workshop participants were also encouraged to continue networking among each other and leverage the new connections made during the workshop, specifically with industry experts, while starting the process of exploring and pursuing secured transaction reforms. As stated by William Baldridge, economic growth team leader for the Middle East Bureau at USAID, “one of the greatest takeaways from this workshop is the network of secured transaction experts and reformers gathered in the room. And in order to move forward in pursuing the reforms needed to increase access to finance for MSMEs in the MENA region, we will all need to work together. We have power in numbers.”