Financial Continuity in Fragile Environments

Opportunities and Risks. In fragile settings, CBDCs present an alternative means to make payments and store funds amid high inflation or disrupted banking infrastructure. By mostly relying on distributed ledger technology, CBDCs and other virtual currencies increase resilience to economic shocks by minimizing vulnerable spots and securing transaction records, which can pay dividends in situations with limited time and resources for transaction verification. This feature is particularly powerful in volatile contexts where offline technology for digital payment is available despite limited internet access.

Effortless payments through digital channels bring accompanying security risks by limiting insights into the source and destination of funds and undermining anti-money laundering financing controls. While DLT presents exciting opportunities to facilitate effective collection and storage of personally identifiable information (PII), its decentralized nature presents cybersecurity concerns that would damage consumer trust – including PII theft, unauthorized disclosure of consumer financial information, or cyberattacks on the ledger, which may be more pronounced in fragile contexts with lower capacity to mitigate such leakages.

Our TradFi Lesson: Comprehensive Cybersecurity Approach. When implementing its e-payment activities, the USAID Philippines E-PESO project saw increased attempts at fraudulent activities amid growing utilization of digital financial services. To tackle this challenge, E-PESO innovated an approach centered within the principle for digital development of privacy and security. First, it strengthened the enabling environment by supporting the Philippines’ Central Bank (BSP) in establishing a Payment System Management Body that implemented settlement security accounts to eliminate risks for real-time transactions and other policies related to anti-money laundering. Second, in partnership with the BSP, the project conducted a cybersecurity policy review aligning with globally recognized cyber resiliency frameworks to identify gaps and deploy appropriate solutions (including implementing a regulatory technology system to oversee the banking industry). Third, the project addressed demand-side cybersecurity concerns by co-creating a cybersecurity awareness program with regulators. This approach boosted trust in digital payments by encouraging basic digital and cybersecurity concepts supporting messages of reliability, privacy, and security. Effective CBDC deployment will similarly necessitate a comprehensive behavioral approach to mitigate cybersecurity risks and boost user trust.

Looking into the Future of Money

For CBDCs to effectively bridge the digital divide and drive financial inclusion, public and private sector actors must collaborate to make investments that build an inclusive, reliable, and trust-based ecosystem rooted within the principles of digital development. Initial investments should focus on aligning technology and local behavioral change strategies, improving regulatory clarity, and designing robust cybersecurity measures to boost stakeholder trust. These investments should be accompanied with targeted initiatives addressing last-mile hurdles to inclusion (i.e., unstable electricity and internet access) to ensure CBDCs protect users and remain accessible to all.

To delve more into the principles for digital development and virtual currency concepts, explore these resources from the Digital Impact Alliance as well as this USAID Examining Virtual Currencies primer.

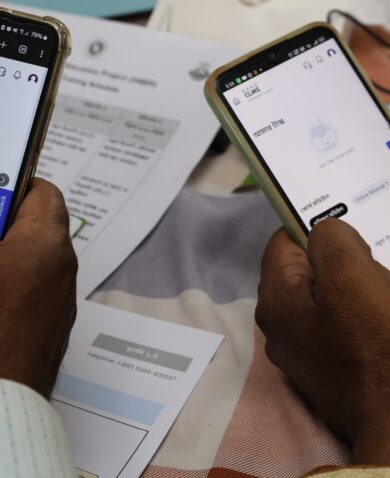

Banner image caption: A merchant in the Philippines advertises the availability of mobile payments in her store. Photo taken by the USAID Philippines E-PESO project.

Posts on the blog represent the views of the authors and do not necessarily represent the views of Chemonics.