Building a Stronger Business Case for Resiliency Planning in Asia

May 1, 2017 | 4 Minute ReadMany businesses want to build greener supply chains, but may lack the financing and knowledge to turn that goal into reality. Can development implementers fill the gap?

The landmark 21st Conference of Parties (COP21) Paris Agreement recognized the need for a multi-pronged approach to reach the ambitious development goals set by 195 countries, 34 of which are in Asia. With one-third of the world’s total population, Asia is increasingly vulnerable to climate change due to its low-lying, heavily populated coastlines and dependency on agricultural exports. The global economic loss in the Asian markets attributed to natural disasters is astounding. In 2016, Vietnam’s water source in the Mekong Delta reached a 90-year record low. This historic drought had a ripple effect on Vietnam’s rice, shrimp, and produce markets and led to $670 million in losses. The 2016 drought not only devastated Vietnam, but distorted the entire global market. Given this, there is an increasingly strong business case for the private sector to build resiliency planning into their business and operation models.

Since the COP21 summit, several multinational corporations in the agriculture, forestry, and other land-use sectors, including Hershey, Starbucks, and L’Oréal, have voluntarily pledged to reduce their emissions and have committed to sourcing their supplies without contributing to deforestation. These firms see a convergence between their immediate responsibility to their shareholders to maintain growth and profits with a responsibility to ensure that they’ll continue to grow in the long term.

Although both governments and the private sector are in agreement about creating more sustainable supply chains, there is a vast financial and knowledge gap needed to operationalize these goals. The limited access to investment capital for small and medium enterprises working in land-use commodities is one of the biggest challenges in reaching these objectives. While multinational corporations have the ability to serve as a conduit for lowering greenhouse gas emissions, they largely rely on an aggregate of supplies from local producers and buyers. These local intermediaries seldom have an awareness of their unsustainable practices nor the financial capital to “green” their supply. Development programs can serve as facilitating partners, for example by helping to accelerate progress by matching suppliers and financiers to encourage investment, improving sourcing of supplies by making them bankable, and leveraging the use of technology. While the solution is varied around the world, there are noteworthy projects making strides in the right direction.

Developing and implementing tools that mitigate environmental damage

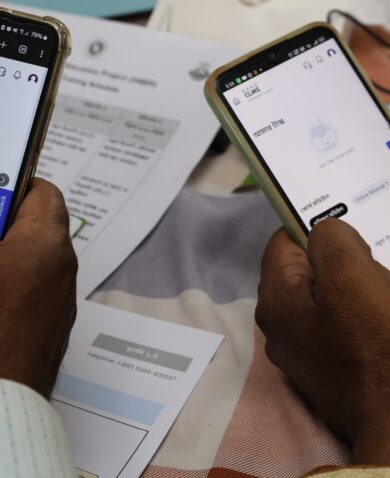

In the Philippines, Chemonics’ USAID-funded Biodiversity and Watersheds Improved for Stronger Economy and Ecosystems Resilience (B+WISER) program works across sectors to improve the management of protected areas and natural forests. With the Philippines Department of Environment and Natural Resources, Chemonics created the LAWIN app, a tool to help forest managers and community patrollers efficiently collect information on forest conditions, environmental threats, and indicator species of forest health. LAWIN replaces the antiquated manual data recording process with tablets and smart phones, via an app developed through the open-source software, CyberTracker. The open-source software provides real-time updates, and serves as empirical evidence of what it takes to address the current lack of resiliency-focused data. Evidence-driven technology like LAWIN is vital for triggering shifts in unsustainable consumer and supplier behavior and can encourage government support for interventions. With 15 percent of the globe’s carbon dioxide emissions coming from forest deforestation, tools like LAWIN have the power to mitigate greenhouse gases. The project continues to increase its impact, and recently brokered a Global Development Alliance with the largest geothermal energy producer in the world, Energy Development Corporation, to adopt and expand the use of LAWIN.

In the Philippines, Chemonics’ USAID-funded Biodiversity and Watersheds Improved for Stronger Economy and Ecosystems Resilience (B+WISER) program works across sectors to improve the management of protected areas and natural forests. With the Philippines Department of Environment and Natural Resources, Chemonics created the LAWIN app, a tool to help forest managers and community patrollers efficiently collect information on forest conditions, environmental threats, and indicator species of forest health. LAWIN replaces the antiquated manual data recording process with tablets and smart phones, via an app developed through the open-source software, CyberTracker. The open-source software provides real-time updates, and serves as empirical evidence of what it takes to address the current lack of resiliency-focused data. Evidence-driven technology like LAWIN is vital for triggering shifts in unsustainable consumer and supplier behavior and can encourage government support for interventions. With 15 percent of the globe’s carbon dioxide emissions coming from forest deforestation, tools like LAWIN have the power to mitigate greenhouse gases. The project continues to increase its impact, and recently brokered a Global Development Alliance with the largest geothermal energy producer in the world, Energy Development Corporation, to adopt and expand the use of LAWIN.

Creating an enabling environment for investment

The Nature Conservancy (TNC), a non-governmental group funded by USAID and other donors, is working through their impact investment division, NatureVest, to demystify the narrative that suggests there is a tradeoff between investing in sustainable land-use projects and expecting a high return on investment. In the past three years, TNC has raised $200 million in sustainable landscape investment deals on three continents with more than 100 investors, including J.P. Morgan, The Robertson Foundation, and the Jeremy and Hannelore Grantham Environmental Trust.

With government collaboration, these funds have been used to create and scale up initiatives such as the $20 million Murray-Darling Basin Balanced Water Fund. The basin produces one-third of Australia’s food supply and accounts for over 39 percent of Australia’s gross value in agricultural production. Under this model, the Balanced Water Fund solicits investments in Australia’s water market and then sells and leases allocations to farmers for agricultural production. The fund donates allocations of water rights back to the environment, ensuring critical wetlands receive the water they require to sustain themselves. This technique has been demonstrated to be effective in managing finite water supplies and provides investors an opportunity to align their portfolios with their socially responsible projects.

For decades, conservationists have largely led the discussion around climate change mitigation, deforestation, and greenhouse gas emission reduction. Development programs have helped to create a more inclusive forum for addressing challenges common to all. The previous examples prove that stakeholders who traditionally have not been engaged in the conversation, such as government, private sector, and civil society, have a vital role to play in scaling up successful models and tools to support more sustainable production and a thriving, more resilient global economy.