Access to Finance for Youth: An Opportunity in Afghanistan

September 22, 2016 | 3 Minute ReadIf more youth are able to access savings, loans, and other financial products, it will help them to invest in their own futures while also growing the Afghan economy.

What is financial inclusion?

Financial inclusion seeks to increase the number of individuals who are able to access formal financial services, with a focus on providing access to marginalized populations such as youth or women. According to the World Bank, almost 40 percent of the adults in the world do not use formal financial services, such as licensed commercial and development banks, savings and loan companies, and deposit-taking entities. The majority of the individuals who do not access these services come from poor households.

Access to bank accounts and loans is an important economic driver that helps citizens invest in their businesses and education and to insulate themselves against financial shocks. Citizens with access to finance are better able to establish and grow businesses, afford education, pay for medical or other emergencies, and live in safer dwellings. Ultimately, access to finance contributes to growth on a larger scale as these benefits trickle up to the economy.

Access to finance in Afghanistan

Afghanistan has a nascent financial sector, which has been growing rapidly in recent years. Despite its recent growth, the World Bank estimates that only 10 percent of Afghans hold an account with a financial institution. This is far below the average of 22 percent for low-income nations. Low levels of financial access in Afghanistan stem from a number of factors, including ongoing conflict and security threats, corruption, weak governance, rampant poverty, and a lack of financial infrastructure.

Access to financial services among Afghan youth

Afghanistan’s population is dominated by youth: 64 percent of its citizens — 20.8 million individuals — are under the age of 25, and 20 percent of the entire population is between 15 and 24 years of age. Despite their numbers, youth ages 15 to 24 are less likely to hold accounts with formal financial institutions compared to older adults. Enabling access to finance for these youth would greatly increase the number of citizens who utilize formal financial institutions, providing a much-needed boost to the Afghan economy.

There are a number of factors that contribute to low levels of financial access among youth in Afghanistan. Young adults tend to have less cash on hand to use as collateral or to deposit when setting up a bank account. They also lack or are unaware of opportunities to learn about available financial services and how to access them. Additionally, there are high rates of illiteracy and unemployment in the country, with a lack of job opportunities for even the most educated youth.

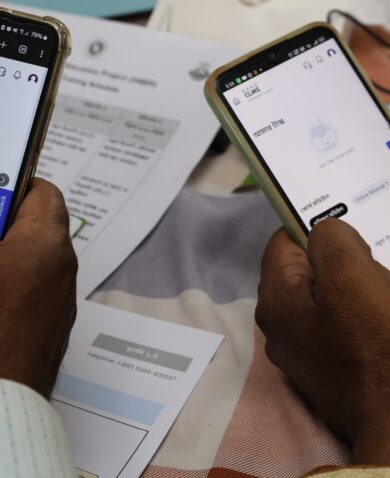

To increase the number of young people who have access to financial services, the Afghan Deputy Ministry of Youth Affairs has been providing more youth-oriented financial training and entrepreneurship programs. In coordination with the Afghan government, USAID’s Financial Access for Investing in the Development of Afghanistan (FAIDA) project provides support to the government and private sector financial institutions to involve youth in market research and product development, to brand loan products for youth, to link youth with financial services, and to provide youth with vocational or other training.

Through the FAIDA project, Chemonics also works with the Afghanistan Microfinance Association (AMA), a national network of development finance institutions, to increase access to finance for youth in a variety of ways. This includes helping the AMA and its members to develop youth-oriented loan products. It also includes helping to organize a series of workshops in partnership with the Deputy Ministry of Youth Affairs to raise awareness among youth-oriented business development organizations on financial institutions’ existing products and services.

Although there still remain many barriers to creating a financially inclusive environment for youth in Afghanistan, there are reasons for optimism. Increasing access to finance will assist youth and other marginalized groups to establish their own businesses and increase their incomes, ultimately stimulating growth as more citizens are able to participate in Afghanistan’s budding financial sector.