E-PESO Activity

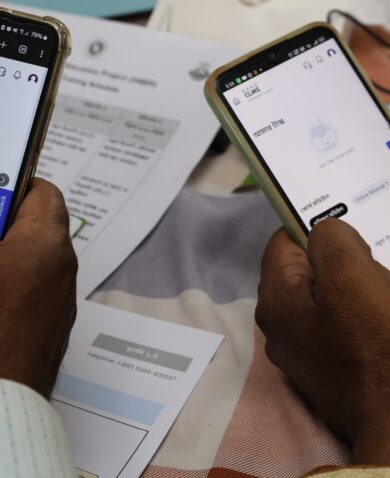

Ninety-nine percent of payments in the Philippines take place via cash or check. In a country made up of more than 7,000 islands where transporting cash is challenging, this system is not only inefficient but also less transparent and inclusive. Electronic payments (e-payments), although not as common in the Philippines, have many advantages over cash: They give more people greater access to financial services and encourage broader participation in the economy. To build a foundation for economic growth, the USAID E-PESO activity is increasing the adoption of e-payments by building a stronger economic infrastructure for cash alternatives.

Prior Initiatives

The E-PESO activity builds on the work of the Microenterprise Access to Banking Services (MABS) projects, which ran from 1997 to 2012. MABS increased access to financial services in the Philippines by collaborating with banks to expand lending opportunities and introduce mobile-banking technologies.

Under MABS, more than 700 rural and other bank branches dispersed $900 million in microfinance loans. Twenty-three thousand farmers obtained more than 57,800 micro-agricultural loans totaling more than $19 million, and mobile-banking services reached more than 139,000 rural Filipinos.