A Conversation with Meliza Agabin and Chemonics CEO and President Jamey Butcher

October 8, 2024 | 4 Minute ReadMeliza “Mely” Agabin has dedicated her life to pioneering digital banking and financial inclusion in the Philippines.

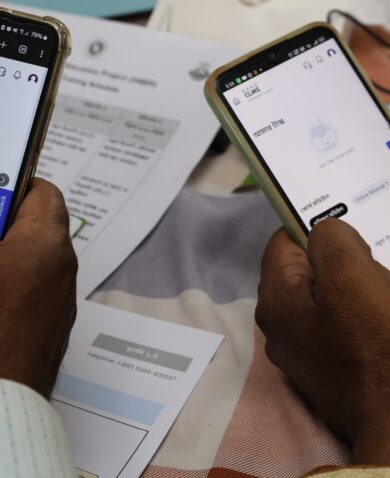

In May 2024, Chemonics CEO and President Jamey Butcher traveled to Manila in the Philippines to launch the innovative, inclusive finance startup Higala. There, he reunited with Meliza “Mely” Agabin, a Filipino teammate who has dedicated her life and career to create positive change in the Philippines. For an incredible 28 years, Mely has been at the heart of Chemonics’ work to transform the Philippines into a leading digital banking hub in Southeast Asia. Her deep expertise and contributions towards the advancement of financial inclusion in the Philippines have been invaluable. Read on to learn more about Mely, her nearly three-decades long career at Chemonics, and how Chemonics has been and continues to be at the forefront of championing financial inclusion for unbanked customers in the Philippines.

Jamey: How long have you worked for Chemonics and how were you first introduced to the organization?

Mely: 28 years. I started working with Chemonics in 1996. My work with Chemonics began at a time of growing concern globally about the exclusion of sectors of the population from the services of formal financial institutions, including farmers with small farm areas and micro, small, and medium-sized family-owned enterprises. Their access to formal finance was either non-existent or very limited. Historically, the unbanked borrow from informal sources with higher interest rates, from relatives, or supplier’s short-term credit.

The very first assignment I took with Chemonics was as a short-term contractor with the USAID/Philippines Microenterprise Access to Banking Services (MABS) program. I was hired to do a study of the rural banking system in the Philippines. My work resulted in an influential study, “An Alternative Approach to Rural Financial Intermediation: The Philippine Experience,” published by Chemonics in 1996.

This study was a key factor to Chemonics’ winning the MABS program. This five-year project was intended to assist rural banks improve their capacity to provide credit and other financial services in their operational areas. I occupied various responsibilities during the stages of the MABS program, including as the senior microfinance specialist, the national technical manager, deputy chief of party, and, lastly, as chief of party in 2012 during the last few months of the project. I was proud that, after the initial five-year implementation period, MABS got two more extensions.

Jamey: Most of your work at Chemonics has been in the microfinance space. What were some meaningful moments that stand out to you?

Mely: I reflected on the history of the rural banking system in the Philippines and how widespread it is, even today.

MABS was designed to change the commercial approach to microfinance in the country and became the early testing ground for new developments such as digital financial services. We implemented the program as a team for close to 15 years!

It’s been particularly meaningful for me to continue to receive very positive feedback from rural banks, stating that they still use what they learned from the MABS training that they participated in. Additionally, it’s very heartwarming to see former staff members of the MABS program who started their careers with me now serving as leaders at some of the most influential Filipino financial institutions. I’ve had the chance to reunite with many of them at the Higala launch event, where they tell me that they still remember and apply what they learned many years ago while working on the MABS program.

Along with the MABS chief of party, we worked to build an environment that was encouraging and open-minded. We continued learning, innovating, and adapting and adopting new approaches and technologies along the way forward. Over the years there were lots of learning opportunities, and exciting discoveries as we designed and tested training materials and strategies.

Following the conclusion of the MABS program, there was an opportunity in 2014 to help with the ground-level research at proposal stage for the USAID’s E-PESO project. Chemonics won the bid in 2015! I’ve continued to stay connected with Chemonics because of its ethical practices, fairness, and compassion to its employees, and respect for the laws of the countries in which it operates. These company virtues are ones that I also take seriously and believe are of great importance.

Jamey: Back in those days, MABS was a groundbreaking program. I remember the chief of party saying that the founder of Google visited MABS because he was trying to understand what digital money looked like.

Mely: Our chief of party was the first person to connect GCash, a mobile payments service in the Philippines, to the global map of digital currency.

I happened to be in Washington, D.C. at the time, speaking at a Chemonics conference, when I received the very first international GCash e-money transfer. It was a historic moment. It was the first overseas financial transaction phone-to-phone—from a rural area in the Philippines to my mobile phone while I was speaking at the conference in Washington, D.C.!

Jamey: That’s incredible. And the whole digital banking world of MABS paved the way for M-PESA in Kenya. Many people are familiar with M-PESA, but few know they studied MABS first and then built the service in East Africa.

Mely: Exactly. So that was exciting. MABS was a very successful project, largely because of our approach to partnership. Our main partners were really the rural banks throughout the country.

Jamey: Do you have any advice for me as president and CEO?

Mely: I attribute some of MABS’ success to how we treated our partners. They were not just recipients. We didn’t simply give them money to lend, which was a departure from how things were done previously. MABS did not dole out money. MABS provided technical assistance and training. And it wasn’t a one-off engagement where you gather people in a classroom one time and tell them this or that. It was training, coaching, visiting with them and with the projects and clients. A true grassroots approach. We knew what was happening with all of our partners.

And we never called our partner banks “beneficiaries.” The banks’ customers were also never called “recipients” since they actually paid for the credit services they received from the banks.

Jamey: That’s awesome, and I share your thinking. I’ve been trying to move our teammates to using the word “customer” and “partner” over “beneficiary.” So, it means a lot to hear you say this, too. Means we’re on the right track.

Mely: Absolutely. We never wanted partners to feel they had to be submissive to us. We never thought of them as beneficiaries. They were our partners.

I have always seen our partners as respected families and individuals. This has given me a perspective that I carried throughout my career.

Also, don’t forget to do field visits to meet with your clients and customers. We visited with our partner banks, visited their clients, and saw their businesses. We would bring our government partners with us, too, and this was so important.

Lastly? Believe in the good that you are working for and do your job with all your heart and with all of your mind.

Jamey: Thank you, Mely. I don’t think I could have received any better advice. I’m so happy we had this opportunity.