Sustained Investment in Sub-Saharan Africa’s Power Hinges on Local and Regional Distribution Companies

July 18, 2017 | 5 Minute ReadUnless distribution companies are better able to collect payment from users, increasing power generation may not be enough to sustainably improve energy access in sub-Saharan Africa.

Refocusing on distribution sector performance

While central governments’ efforts in sub-Saharan Africa — with the support of the donor community — often focus on reducing risks to investment in new generation, the long-term financial and political sustainability of increased energy access depends equally on the success of local distribution companies. As noted in Mark Tomlinson’s earlier blog post, achieving the Sustainable Development Goals (SDGs) for electricity access will require some $800 billion in investment from now until 2030. Absent this, overall economic growth could slow by as much as 5 percent per annum.

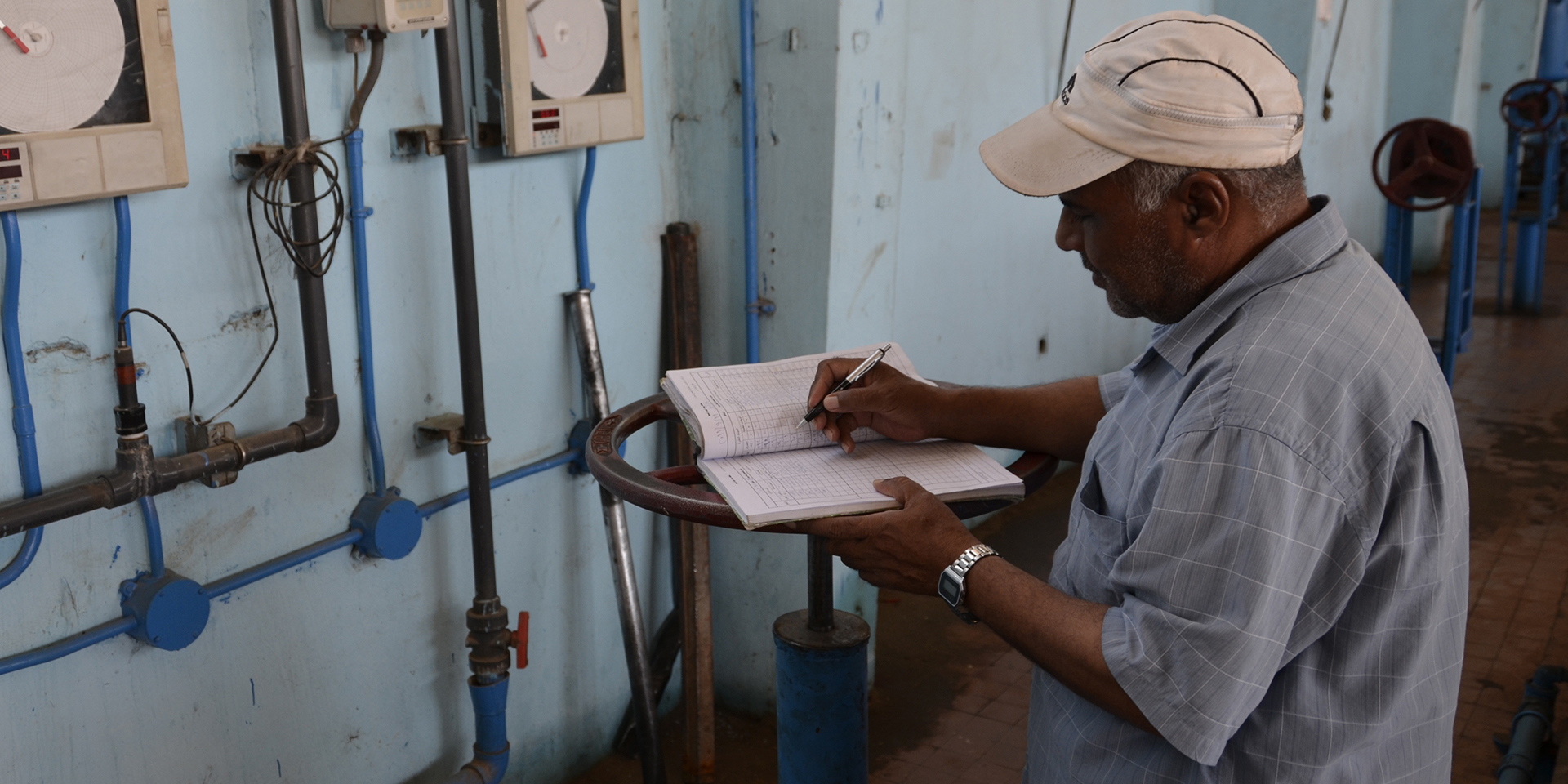

As energy reforms continue across the sub-continent, policymakers and donors, guided by the SDGs, must now also improve the local policies, regulations, and institutional capacity critical to the success of electricity distribution. Small or large grid-connected or mini-grid distribution companies fulfill the vital role of collecting revenue from residential and commercial end users in exchange for providing electricity. Ultimately, it is the cash flows from payments to distribution companies that underwrite any investment in energy security and supply, including additional generation capacity.

This post identifies several key issues by first explaining the role of distribution companies in energy markets and then suggesting initial approaches to improving their performance. Notably, the ways we understand and support improved service delivery and revenue collection in the electricity sector are common to other utility-type service sectors.

Why distribution is critical: Follow the money

In modern, open energy markets, distribution companies are responsible for successfully delivering electricity to residential and commercial end users at the point of sale, in exchange for payment. Like the grocery stores that sell food or the fueling stations that sell gasoline, distribution companies represent the retail sector collecting revenue that is then passed back up through the value chain to private generators and transmission system operators, in the case of grid systems. In either case, if end users are not paying the full cost of the electricity, just as if we do not pay the full cost of the food in our grocery stores, investment in infrastructure falls and upstream producers simply stop producing.

End-user orientation is not new, but perhaps neglected

Improving energy access through modern and innovative distribution is a not new idea. In places where conventional, large-scale infrastructure approaches are either failing to reach rural populations or to reliably serve customers in cities, “beyond the grid” distribution companies are filling the gap. The most prominent examples are mini- and micro-grid developments, as well as distributed generation and other energy solutions at the level of individual households and small commercial enterprises. As the costs of distributed generation have fallen, particularly for systems based on hybrid PV solar and storage, independent distributors can effectively organize individual demand into sub-markets capable of financing construction, operation, and maintenance for local power. In Kenya and Tanzania, for example, customer-oriented mini-grid systems that integrate mobile payment technologies are leapfrogging grid extension organized by the central government.

At the same time, to the extent that policymakers and donors focus on large-scale investment in new grid-connected generation plants and national transmission systems, they may be neglecting the distribution sector’s ability to deliver electricity to, and collect revenue from, end users. Ongoing losses from theft and poor equipment plague the sector across sub-Saharan Africa, for example. Distribution companies also lack local capacity for transparent governance, sound financial management, and technical know-how necessary to reduce those losses from theft and waste. As a result of these common challenges, reform efforts at the central government level — often led by the donor community — have been largely unable to increase electricity access on the back of locally-controlled and managed companies that pass revenue back up through the power markets.

Not all retail actors are the same

To fully understand the challenge of improving distribution company performance, it is important to understand the economics of utility services overall. Energy supply, like water supply, wastewater treatment, and solid waste management, represent both public services and private goods. They are public services because they require large capital investments and contribute to shared economic growth. Cheap electricity enables households, small businesses, and large industrial enterprises to grow, trash collection and disposal reduces disease and improves qualify of life, and access to water coupled with wastewater treatment speaks for itself — all shared benefits of a local utility company’s work. Electric distribution companies are also retail sellers of a private good because they exchange payments for delivery of a scarce product, e.g. kilowatt-hours, to individual buyers. Unlike grocery stores or gas stations, these markets are what economist call “natural monopolies.” Natural monopolies function optimally when retailers are able to control enough of the end-user market to pay for the very high upstream capital and maintenance costs necessary to produce and deliver the final product.

Next steps: Identify the challenge and refocus on the retail sector

In sub-Saharan Africa, like anywhere else, distribution companies are tasked with arguably the most difficult role in power markets: collecting revenue to provide steady cash flows into the market on the one hand, and providing reliable, often constant, electricity in a timely fashion to customers on the other. In Nigeria today, for example, recently privatized distribution companies are simultaneously loathed for their bad performance while being expected to modernize under some of the most difficult socioeconomic circumstances imaginable. Regardless, they are the last entity between power supply and consumption, the final “power off-taker” in the parlance of energy professionals. Successfully creating, maintaining, and improving retail power services is therefore critical to broader market performance.

Oft-cited challenges at the distribution level include: political manipulation of wholesale power supply, which undermines distributors’ ability to provide power as promised to local customers; local entities’ inability to fully account for costs of personnel and the purchase, installation, and maintenance of equipment for distribution systems; collusion between collectors and customers to steal revenue; and broader social perceptions of electricity supply as a public right, which overlook the costs of energy as a private good.

In light of the tremendous demand for power in sub-Saharan Africa, policymakers, regulators, donors, and even private investors need to support more interventions on behalf of distribution that result in true payment-for-service models. Among others, these should include:

1. Capacity building and training to improve customer relations and increase professionalism of “front-line” staff

The experiences of mini-grid companies provide examples of successful businesses that focus on customer needs, installing “pay-as-you-go” collection systems and streamlining maintenance and operations. The same practical, business-minded management should drive the performance of distribution companies buying and selling power to customers on the grid. Front-line personnel who interact with customers need professional and technical training to practice quality service provision to those buying their power. Controlled studies in Bihar, India, led by the Energy Policy Institute at the University of Chicago (EPIC), indicate that under the right incentive schemes, front-line staff will work with end users to reduce theft and increase service provision, for which customers are willing to pay higher tariffs.

2. Asset planning and acquisition combined with operational capabilities

To perform effectively as service companies, distributors need the ability to identify asset needs, pay for acquisition and installation, and successfully operate those assets. This includes inverters, meters, poles and wires, data collection and management systems, and truck fleets, among others. The assets plans in turn dictate the skill requirements for new personnel to operate them. Both asset and personnel/operational planning need to be driven by a commitment to understand and deliver what the customer wants.

3. Financial planning and management expertise

Distribution companies also support delivery on national and sub-national policies directed at economically disadvantaged populations. These usually take the form of “lifeline” tariffs for targeted classes of end users. In the absence of rigorous financial planning and accounting practices, however, the need to recover full costs and deliver on social objectives can result in hidden cross-subsidies that exacerbate inequities.

As we energy development professionals continue our work in sub-Saharan Africa, we must pay careful attention to the health and strength of distribution companies and the retail sector. They are too often overlooked in the quest for more generation and transmission capacity, but are responsible for arguably the most important part of the power market value chain.